Prepaid Solutions

Overview

With our prepaid solution, you can extend prepaid products to customers without constraints such as credit rating, income, or bank account ownership. The solution includes issuer, branch, corporate, or cardholder web-based portals, enabling effortless sales, maintenance, load, and card or customer lifecycle management. These features empower non-banked customers to manage their finances like seasoned professionals, making financial management more accessible and straightforward.

Activate prepaid cards

Users can activate prepaid cards when they are first issued or after they have been deactivated for any reason.

Check card balances

Users can check the balance on a prepaid card in real-time or on a scheduled basis.

View transaction history

Users can view a detailed record of all transactions made with a prepaid card, including the date, time, amount, and location of each transaction.

Reload cards

Users can add funds to a prepaid card, either by transferring money from another account or by purchasing a reload card.

Resolve disputes

Users can access a process for resolving disputes or issues that may arise with prepaid card transactions.

Manage card accounts

Users can view and manage their prepaid card accounts, including the ability to set spending limits, view transaction history, and update personal information.

Card Create

Status:

Production

Version:

V2

Product:

Prepaid Solutions

Card Create

Overview

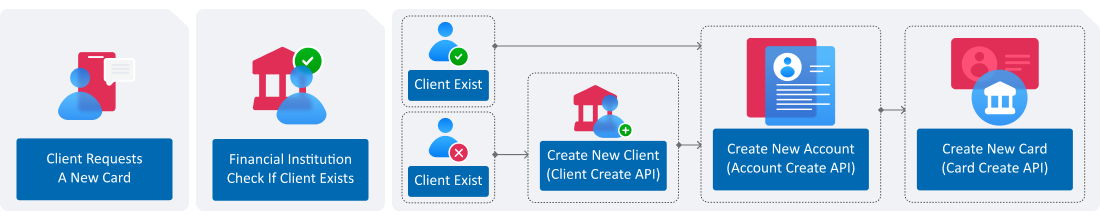

The Card Create API is used to cards for customers. It accepts various parameters such as customer information, account information, card type, and custom fields.

Efficient Card Creation

Quickly create a new card with just a few parameters.

Customizable Features

Customize various card features, including cardholder name, product code, and currency.

Virtual Card Option

Option to create a virtual card with the "card_virtual_indicator" parameter.

How It Works

The Card Create API is used to create new cards for customers. The API accepts parameters such as customer ID, account number, card type, institution ID, cardholder name, product code, card role, card date open, currency, and custom fields. Once the required parameters are set, the API executes the creation of the new credit card and returns a response indicating the success or failure of the transaction.

If the card is related to multi-currency product, you have 2 options, either to provide the base wallet number in account_number, or to provide the top account number in the same field but to send key “contract_idt_scheme” with value “CN:WALLET_BASE” under custom_fields.

Status:

Production

Version:

V2

Product:

Prepaid Solutions

| Node | Child Node | Type | Length | Description |

|---|---|---|---|---|

| Authorization | Bearer xxxx | string | Authorization Header (Bearer Token) | |

| Content-Type | application/json | string | Content Type |

| Node Type | Type | Length | Description | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| header | msg_id | string | 12 | Message ID, this field should be unique id for each Api call. This will be generated from client side. If the same message ID is used the system will decline the API call with Error Description “Duplicate Message ID” | ||||||

| msg_type | string | 12 | Message Type – This can have either “TRANSACTION” or “ENQUIRY” As for this API the value expected is “TRANSACTION” | |||||||

| msg_function | string | 50 | Message functions: Should be “REQ_CARD_CREATE” | |||||||

| src_application | string | 10 | Source Application: This is a free Text and the client can populate the source system from where the API is Initiated Example: IVR, IB, MB No Validations of these are kept at Network Systems | |||||||

| target_application | string | 10 | The target_application can hold any value from FI side, this can be used by FI to check the target system of the API call | |||||||

| timestamp | string | 30 | Timestamp of the request - Format YYYY-MM-DDtHH:MM:SS.SSS+04:00 | |||||||

| bank_id | string | 4 | Bank Id is Unique Id 4 digit code for each client and the same will be provided once the client setup is completed in our core system. For sandbox testing – Please use “NIC” | |||||||

| body | customer_id | string | 20 | Customer ID: Customer Identification number This should be a unique number | ||||||

| account_number | string | 64 | Account number | |||||||

| card_type | string | 7 | Informative value to the request, does not have any functional impact, the value can be PREPAID/CREDIT/DEBIT | |||||||

| card | customer_id | string | 20 | Customer ID: Customer Identification number This should be a unique number | ||||||

| account_number | string | 64 | Account number | |||||||

| institution_id | string | 5 | institution id is the code that is created for each bank or FI(it is the same value as bank code), 982 value is just used as an example in Sandbox | |||||||

| card_identifier_type | string | 20 | CONTRACT_NUMBER is used for clear card number or EXID which is a unique identifier for the card generated by CMS | |||||||

| card_identifier_id | string | 32 | Clear card number generated by FI system. If it was not provided, CMS will generate it | |||||||

| card_expiry_date | string | 4 | Format YYMM. If it was not provided, CMS will generate it | |||||||

| cardholder_name | string | 21 | Cardholder name | |||||||

| product_code | string | 32 | Product code, this code is generated by CMS after creating the product, this code is FI spesific code 982_AED_002_P is just used as an example in Sandbox" | |||||||

| card_date_open | string | 10 | Date of card contract creation | |||||||

| currency | string | 3 | Informative value to the request, does not have any functional impact, the currency will be taken from the product | |||||||

| card_virtual_indicator | string | 1 | V - Virtual P - Physical | |||||||

| limit | type | string | 32 | Credit limit, applicable only for credit cards, Type of limit: FIN_LIMIT, CR_LIMIT_PCNT (Supplementary card only) | ||||||

| currency | string | 3 | Credit limit currency | |||||||

| value | string | 20 | Credit limit value | |||||||

| custom_fields | key | string | 20 | Custom Tag. Example: contract_idt_scheme | ||||||

| value | string | 128 | Tag value. Example: CONTRACT_NUMBER | |||||||

{

"NISrvRequest": {

"request_card_create": {

"header": {

"msg_id": "1593093024",

"msg_type": "TRANSACTION",

"msg_function": "REQ_CARD_CREATE",

"src_application": "IVR",

"target_application": "WAY4",

"timestamp": "2020-07-20T10:49:02.366+04:00",

"bank_id": "NIC"

},

"body": {

"customer_id": "100000027",

"account_number": "0009821110000000008",

"card_type": "CREDIT",

"card": {

"customer_id": "100000027",

"account_number": "0009821110000000008",

"institution_id": "982",

"cardholder_name": "JOHN DOE",

"product_code": "982_AED_042_P",

"card_date_open": "2022-01-01",

"currency": "AED",

"card_virtual_indicator": "V",

"instant_issuance": {

"online_embossing": "Y",

"embossing_tags": [

{

"key": "EF.TAG1",

"value": "A1B2C3D4E5"

}

]

},

"limit": {},

"custom_fields": [

{

"key": "contract_idt_scheme",

"value": "CONTRACT_NUMBER"

}

]

}

}

}

}

}| Node | Child Node | Type | Length | Description | |||

|---|---|---|---|---|---|---|---|

| Content-Type | application/json | string | Content Type | ||||

| Node Type | Type | Length | Description | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| NISrvResponse | response_card_create | header | msg_id | string | 12 | Message ID, this field should be unique id for each Api call. This will be generated from client side. If the same message ID is used the system will decline the API call with Error Description “Duplicate Message ID” | ||||

| msg_type | string | 12 | Message Type – This can have either “TRANSACTION” or “ENQUIRY” As for this API the value expected is “TRANSACTION” | |||||||

| msg_function | string | 50 | Message functions: Should be “REP_CARD_CREATE” | |||||||

| src_application | string | 10 | Source Application: This is a free Text and the client can populate the source system from where the API is Initiated Example: IVR, IB, MB No Validations of these are kept at Network Systems | |||||||

| target_application | string | 10 | The target_application can hold any value from FI side, this can be used by FI to check the target system of the API call | |||||||

| timestamp | string | 15 | Timestamp of the response - Format YYYY-MM-DDtHH:MM:SS.SSS+04:00 | |||||||

| bank_id | string | 4 | Bank Id is Unique Id 4 digit code for each client and the same will be provided once the client setup is completed in our core system. For sandbox testing – Please use “NIC” | |||||||

| exception_details | application_name | string | 20 | Application Name | ||||||

| date_time | string | 30 | Timestamp of the response Format “YYYY-MM-DD HH:MM:SS” | |||||||

| status | string | 1 | Status of the request (S/F) | |||||||

| error_code | string | 4 | EAI Internal Error Code (Check error codes section for the complete list of error codes and error code descriptions) | |||||||

| error_description | string | 100 | Error Description (Check error codes section for the complete list of error codes and error code descriptions) | |||||||

| transaction_ref_id | string | 20 | The tracking_id sent in the request will be sent back in response in this field. | |||||||

| body | card_identifier_id | string | 32 | CardValue of card number, Token number, Ext_number | ||||||

| card_identifier_type | string | 20 | CONTRACT_NUMBER is used for clear card number or EXID which is a unique identifier for the card generated by CMS | |||||||

| masked_pan | string | 16 | Masked PAN | |||||||

| card_virtual_indicator | string | 1 | P- Physical V- Virtual | |||||||

| custom_fields | key | string | 32 | Custom Tag e.g. contract_idt_scheme | ||||||

| value | string | 128 | Custom Tag value | |||||||

{

"NISrvResponse": {

"response_card_create": {

"header": {

"msg_id": "236001",

"msg_type": "TRANSACTION",

"msg_function": "REP_CARD_CREATE",

"src_application": "IVR",

"target_application": "WAY4",

"timestamp": "2020-07-20T06:49:02.366Z",

"bank_id": "NIC"

},

"exception_details": {

"application_name": "TCC-ADP",

"date_time": "2023-02-01T16:39:47.314+04:00",

"status": "S",

"error_code": "000",

"error_description": "Success",

"transaction_ref_id": "236001"

},

"body": {

"card_identifier_id": "99985101161390700708",

"card_identifier_type": "EXID",

"masked_pan": "999851XXXXXX8349",

"card_virtual_indicator": "V",

"custom_fields": [

{

"key": "contract_idt_scheme",

"value": "CONTRACT_NUMBER"

}

]

}

}

}

}| Code | Description |

|---|---|

| 200 | Sample Description |

| 400 | Bad Request |

| 401 | Unauthorized |

| 403 | Forbidden |

| 500 | Internal Server Error |

| 502 | Bad gateway |

| 503 | Scheduled Maintenance |

| 504 | Gateway Timeout |

| 596 | Service Not Found |

Prepaid Solutions

Prepaid Solutions