Credit Solutions

Overview

Our one-stop, centralized solution for Credit Card processing is designed to provide you with a seamless and secure payment experience. Whether you are a small business or a large enterprise, our solution is cost-effective, easily configurable, and scalable to meet your specific needs.

With our Credit Card processing solution, you can easily accept payments from your customers and offer flexible credit options. Our platform supports all major credit card networks, so you can serve customers regardless of their issuing bank.

Activate Credit cards

Users can activate credit cards when they are first issued or after they have been temporarily suspended.

Check Available Credit

Users can check their available credit limit and outstanding balance in real-time or on a scheduled basis.

View Transaction History

Users can view a detailed record of all transactions made with a credit card, including the date, time, amount, and merchant details.

Make Payments

Users can pay their credit card bills through multiple channels, including online transfers, auto-debit, or in-person payments.

Resolve disputes

Users can access a process for resolving disputes or issues that may arise with credit card transactions, ensuring timely resolution and customer satisfaction.

Protect against fraud

Users can access measures to detect and prevent fraudulent activity on credit cards, such as monitoring for suspicious activity, enabling transaction alerts, and requiring additional authentication for high-value transactions.

Manage card accounts

Users can view and manage their credit card accounts, including the ability to set spending limits, view transaction history, update personal information, and manage rewards or loyalty points.

Client Create

Status:

Production

Version:

V2

Product:

Credit Solutions

Client Create....

Overview

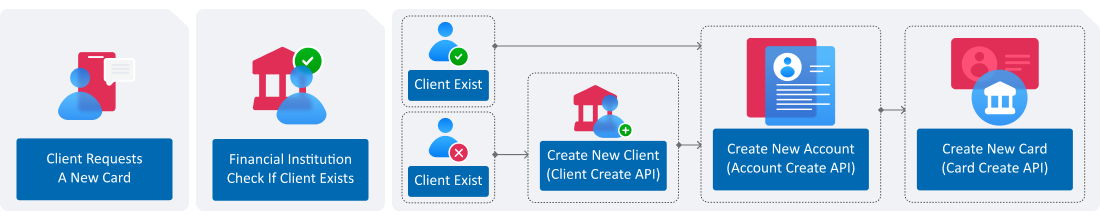

The Client Create API can be used by financial institutions to create new client records within our system. A client, in this context, can refer to a person or an organization.

The API allows institutions to input and store personal information, addresses, and identity documents associated with the client. The client record is the highest level in the data hierarchy and serves as the foundation for other related information, such as accounts and transactions.

The API allows institutions to input and store personal information, addresses, and identity documents associated with the client. The client record is the highest level in the data hierarchy and serves as the foundation for other related information, such as accounts and transactions. This API is typically used as a part of the onboarding process for new clients and can be integrated into existing systems and workflow.

Create new clients

API allows financial institutions to create new client records, including personal information, addresses, and identity documents.

Flexible data structure

The API supports a flexible data structure, allowing financial institutions to store and retrieve various types of client information.

Hierarchical organization

The API organizes client information in a hierarchical manner, with client records serving as the highest level in the hierarchy. This allows for easy management and organization of client data.

How It Works

When the API is called, it requires the input of certain information such as the client's name, contact information, and identification documents. This information is then processed and stored in the institution's database, creating a new client record.

In action, the API would be called by the financial institution's system, passing in the required information as parameters. The API would then process the information and create a new client record in the institution's database.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Amet, sed at amet cras fringilla adipiscing nunc, in pulvinar. Sagittis pellentesque leo et proin convallis justo vitae in.

Process 1

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Amet, sed at amet cras fringilla adipiscing nunc, in pulvinar. Sagittis pellentesque leo et proin convallis justo vitae in.

Process 1

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Amet, sed at amet cras fringilla adipiscing nunc, in pulvinar. Sagittis pellentesque leo et proin convallis justo vitae in.

Process 1

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Amet, sed at amet cras fringilla adipiscing nunc, in pulvinar. Sagittis pellentesque leo et proin convallis justo vitae in.

Status:

Production

Version:

V2

Product:

Credit Solutions

| Node | Child Node | Type | Length | Description |

|---|---|---|---|---|

| Authorization | Bearer xxxx | string | Authorization Header (Bearer Token) | |

| Content-Type | application/json | string | Content Type |

| Node Type | Type | Length | Description | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| header | msg_id | string | 12 | Message ID, this field should be unique id for each Api call. This will be generated from client side. If the same message ID is used the system will decline the API call with Error Description “Duplicate Message ID” | ||||||

| msg_type | string | 12 | Message Type – This can have either “TRANSACTION” or “ENQUIRY” As for this API the value expected is “TRANSACTION” | |||||||

| msg_function | string | 50 | Message functions: Should be “REQ_CLIENT_CREATE” | |||||||

| src_application | string | 10 | Source Application: This is a free Text and the client can populate the source system from where the API is Initiated Example: IVR, IB, MB No Validations of these are kept at Network Systems | |||||||

| target_application | string | 10 | The target_application can hold any value from FI side, this can be used by FI to check the target system of the API call | |||||||

| timestamp | string | 30 | Timestamp of the request - Format YYYY-MM-DDtHH:MM:SS.SSS+04:00 | |||||||

| bank_id | string | 4 | Bank Id is Unique Id 4 digit code for each client and the same will be provided once the client setup is completed in our core system. For sandbox testing – Please use “NIC” | |||||||

| body | customer_id | string | 20 | Unique identifier of the client. The value should be unique for each transaction, else the API will be errored out with error message - “Duplicate client number”. 100000027 is sample value for reference please use different values for testing. | ||||||

| bank_code | string | 3 | Bank code is Unique Id 3 digit number for each client and the same will be provided once the client setup is completed in our core system. For sandbox testing – “982” is used. | |||||||

| external_client_number | string | 20 | This is additional unique identifier for the client. | |||||||

| card_name | string | 21 | Card embossing name defined on client level should be in Upper case | |||||||

| card_type | string | 7 | Informative value to the request, does not have any functional impact, the value can be PREPAID/CREDIT/DEBIT | |||||||

| personal_details | gender | string | 6 | Gender of the client. The given options are - M: Male F: Female N: Not specified. | ||||||

| title | string | 4 | The Title of the client. The expected options are - MR, MRS, MISS, MS, DR, Shaikh, Shaikha | |||||||

| first_name | string | 255 | First Name of the client | |||||||

| last_name | string | 255 | Last Name of the client | |||||||

| middle_name | string | 255 | Middle Name of the client | |||||||

| citizenship | string | 3 | Citizenship of the client | |||||||

| marital_status | string | 18 | Marital status of the client Expected values are - S: Single, M: Married, D: Divorced, X: Misc., W: Widow | |||||||

| date_of_birth | string | 15 | Birth Date of the client in the following format yyyy-mm-dd | |||||||

| place_of_birth | string | 255 | Birth place of the client | |||||||

| language | string | 3 | This defines the language in which the user would like to recieve 3D secure OTP or any transactional notifications. By default notifications will be sent in English language. The value should be provided in ISO language format. | |||||||

| security_name | string | 255 | This field is used by Fraud monitoring agents to validate cardholder's verification on the call. This is not mandatory for issuers who are not using Fraud monitoring service | |||||||

| contact_details | home_phone | string | 32 | Home phone number of the client, its recommended to pass the value with country code | ||||||

| work_phone | string | 32 | Work phone number of the client, its recommended to pass the value with country code | |||||||

| mobile_phone | string | 32 | Mobile phone of the client, its recommended to pass the value with country code | |||||||

| string | 255 | Valid email address of the client | ||||||||

| addresses | address_type | string | 20 | The type of the address, just like multiple phone number types, we can have multiple addresses type . Ex PERMANENT/PRESENT/WORK/HOME | ||||||

| address_line_1 | string | 255 | Building Name of the address | |||||||

| address_line_2 | string | 255 | This defines wheather the address belongs to the Landlord or the Tenant. | |||||||

| address_line_3 | string | 255 | House Name or House Number of the address | |||||||

| address_line_4 | string | 255 | Street Name of the address | |||||||

| string | 255 | Valid email address of the client | ||||||||

| phone | string | 32 | Phone number | |||||||

| city | string | 255 | City name | |||||||

| country | string | 255 | Country Code Ex SAU | |||||||

| zip | string | 32 | Zip Code | |||||||

| state | string | 32 | State | |||||||

| identity_proof_document | number | string | 20 | An identity number can be any valid id number which is provided by government that may be used to prove a person's identity. | ||||||

| type | string | 20 | An identity document's type the expected document types are passport,nationalId,driving licence | |||||||

| expiry_date | string | 10 | The identity document's expiry date the format should be - YYYY-MM-DD | |||||||

| supplementary_documents | number | string | 20 | Supplemental documents are supporting materials | ||||||

| type | string | 20 | Supplemental documents are supporting materials | |||||||

| expiry_date | string | 10 | YYYY-MM-DD | |||||||

| employment_details | employer_name | string | 64 | Company Name of the client | ||||||

| income | string | 64 | Income of the client | |||||||

| occupation | string | 64 | Occupation/Trade | |||||||

| custom_fields | key | string | 20 | Custom Tag. Ex: client_type | ||||||

| value | string | 128 | Tag value. Ex: CLIENT_PRIV | |||||||

{

"NISrvRequest": {

"request_client_create": {

"header": {

"msg_id": "990742675747",

"msg_type": "TRANSACTION",

"msg_function": "REQ_CLIENT_CREATE",

"src_application": "BNK",

"target_application": "WAY4",

"timestamp": "2023-09-11 14:11:54.822+0400",

"tracking_id": "",

"bank_id": "NIC"

},

"body": {

"customer_id": "100000027",

"bank_code": "982",

"external_client_number": "100000027",

"card_name": "JAMES ROBERT",

"card_type": "CREDIT",

"personal_details": {

"gender": "M",

"title": "MR",

"first_name": "James",

"last_name": "Robert",

"middle_name": "Ivich",

"citizenship": "ARE",

"marital_status": "M",

"date_of_birth": "1955-08-25",

"place_of_birth": "Dubai",

"language": "ENG",

"security_name": "Tima"

},

"contact_details": {

"home_phone": "919702310992",

"work_phone": "919702310992",

"mobile_phone": "919702310992",

"email": "James.Robert@network.global"

},

"addresses": [

{

"address_type": "PERMANENT",

"address_line_1": "Al Mahata Towers",

"address_line_2": "LandLord",

"address_line_3": "House no - 1105",

"address_line_4": "Al Qasmia",

"city": "Dubai",

"country": "ARE",

"zip": "24537",

"state": "Dubai"

}

],

"identity_proof_document": [

{

"number": "R589856",

"type": "Passport",

"expiry_date": "2025-05-20"

}

],

"supplementary_documents": [

{

"number": "R589856",

"type": "Passport",

"expiry_date": "2025-05-20"

}

],

"employment_details": [

{

"employer_name": "ABC Pvt Ltd",

"income": "20000",

"occupation": "Engineer"

}

],

"custom_fields": [

{

"key": "client_type",

"value": "CLIENT_PRIV"

}

]

}

}

}

}| Node | Child Node | Type | Length | Description | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Content-Type | application/json | string | Content Type | |||||||||||||||||||||||||||||

| Node Type | Type | Length | Description | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| header | msg_id | string | 12 | Message ID, this field should be unique id for each Api call. This will be generated from client side. If the same message ID is used the system will decline the API call with Error Description “Duplicate Message ID” | ||||||

| msg_type | string | 12 | Message Type – This can have either “TRANSACTION” or “ENQUIRY” As for this API the value expected is “TRANSACTION” | |||||||

| msg_function | string | 50 | Message functions: Should be “REP_CLIENT_CREATE” | |||||||

| src_application | string | 10 | Source Application: This is a free Text and the client can populate the source system from where the API is Initiated Example: IVR, IB, MB No Validations of these are kept at Network Systems | |||||||

| target_application | string | 10 | The target_application can hold any value from FI side, this can be used by FI to check the target system of the API call | |||||||

| timestamp | string | 15 | Timestamp of the response - Format YYYY-MM-DDtHH:MM:SS.SSS+04:00 | |||||||

| bank_id | string | 4 | Bank Id is Unique Id 4 digit code for each client and the same will be provided once the client setup is completed in our core system. For sandbox testing – Please use “NIC” | |||||||

| exception_details | application_name | string | 20 | Application Name | ||||||

| date_time | string | 30 | Timestamp of the response Format YYYY-MM-DD HH:MM:SS | |||||||

| status | string | 1 | Status of the request (S/F) | |||||||

| error_code | string | 4 | EAI Internal Error Code (Check error codes section for the complete list of error codes and error code descriptions) | |||||||

| error_description | string | 100 | Error Description (Check error codes section for the complete list of error codes and error code descriptions) | |||||||

| transaction_ref_id | string | 20 | The tracking_id sent in the request will be sent back in response in this field. | |||||||

| body | customer_id | string | 20 | Customer ID: Customer Identification number This should be a unique number | ||||||

| bank_code | string | 3 | Bank code is Unique Id 3 digit number for each client and the same will be provided once the client setup is completed in our core system. For sandbox testing – “982” is used | |||||||

| external_client_number | string | 20 | additional identifier for the client that is generated by FI system | |||||||

| card_name | string | 21 | Card embossing name defined on client level (Upper case) | |||||||

| personal_details | gender | string | 6 | Gender ex Male | ||||||

| title | string | 4 | Title ex Mr | |||||||

| first_name | string | 255 | First Name ex James | |||||||

| last_name | string | 255 | Last Name ex Robert | |||||||

| middle_name | string | 255 | Last Name ex Ivich | |||||||

| citizenship | string | 3 | Citizenship | |||||||

| marital_status | string | 18 | Marital Status | |||||||

| date_of_birth | string | 20 | Date of birth | |||||||

| place_of_birth | string | 255 | Place of birth | |||||||

| language | string | 3 | Language ISO code | |||||||

| security_name | string | 255 | Security Name | |||||||

| contact_details | home_phone | string | 32 | Home Phone Number | ||||||

| work_phone | string | 32 | Work Phone Number | |||||||

| mobile_phone | string | 32 | Mobile Number | |||||||

| string | 255 | Email address | ||||||||

| addresses | address_type | string | 20 | The type of the address, just like multiple phone number types, we can have multiple addresses type . Ex PERMANENT/PRESENT/WORK/HOME | ||||||

| address_line_1 | string | 255 | Building Name of the address | |||||||

| address_line_2 | string | 255 | This defines wheather the address belongs to the Landlord or the Tenant. | |||||||

| address_line_3 | string | 255 | House Name or House Number of the address | |||||||

| address_line_4 | string | 255 | Street Name of the address | |||||||

| string | 255 | Valid email address of the client | ||||||||

| phone | string | 32 | Phone number | |||||||

| city | string | 255 | City name | |||||||

| country | string | 255 | Country Code Ex SAU | |||||||

| zip | string | 32 | Zip Code | |||||||

| state | string | 32 | State | |||||||

| identity_proof_document | number | string | 20 | An identity number can be any valid id number which is provided by government that may be used to prove a person's identity. | ||||||

| type | string | 20 | An identity document's type the expected document types are passport,nationalId,driving licence | |||||||

| expiry_date | string | 10 | The identity document's expiry date the format should be - YYYY-MM-DD | |||||||

| supplementary_documents | number | string | 20 | Supplemental documents are supporting materials | ||||||

| type | string | 20 | Supplemental documents are supporting materials | |||||||

| expiry_date | string | 10 | YYYY-MM-DD | |||||||

| employment_details | employer_name | string | 64 | Company Name of the client | ||||||

| income | string | 64 | Income of the client | |||||||

| occupation | string | 64 | Occupation/Trade | |||||||

| custom_fields | key | string | 20 | Custom Tag. Ex: client_type | ||||||

| value | string | 128 | Tag value. Ex: CLIENT_PRIV | |||||||

{

"NISrvResponse": {

"response_client_create": {

"header": {

"msg_id": "99056447",

"msg_type": "TRANSACTION",

"msg_function": "REP_CLIENT_CREATE",

"src_application": "BNK",

"target_application": "WAY4",

"timestamp": "2024-02-15T15:36:40.447+04:00",

"tracking_id": "",

"bank_id": "NIC"

},

"exception_details": {

"application_name": "TCC-ADP",

"date_time": "2024-02-15T15:36:40.447+04:00",

"status": "S",

"error_code": "000",

"error_description": "Success"

},

"body": {

"customer_id": "100000027",

"bank_code": "982",

"external_client_number": "100000027",

"card_name": "JAMES ROBERT",

"card_type": "CREDIT",

"personal_details": {

"gender": "M",

"title": "MR",

"first_name": "James",

"last_name": "Robert",

"middle_name": "Ivich",

"citizenship": "ARE",

"marital_status": "M",

"date_of_birth": "1955-08-25",

"place_of_birth": "Dubai",

"language": "ENG",

"security_name": "Tima"

},

"contact_details": {

"home_phone": "919702310992",

"work_phone": "919702310992",

"mobile_phone": "919702310992",

"email": "James.Robert@network.global"

},

"addresses": [

{

"address_type": "PERMANENT",

"address_line_1": "Al Mahata Towers",

"address_line_2": "LandLord",

"address_line_3": "House no - 1105",

"address_line_4": "Al Qasmia",

"city": "Dubai",

"country": "ARE",

"zip": "24537",

"state": "Dubai"

}

],

"identity_proof_document": [

{

"number": "R589856",

"type": "Passport",

"expiry_date": "2025-05-20"

}

],

"supplementary_documents": [

{

"number": "R589856",

"type": "Passport",

"expiry_date": "2025-05-20"

}

],

"employment_details": [

{

"employer_name": "ABC Pvt Ltd",

"income": "20000",

"occupation": "Engineer"

}

],

"custom_fields": [

{

"key": "CL-CLIENT_PRIOR",

"value": "0"

},

{

"key": "CL-COMPANY_NAME",

"value": "ABC Pvt Ltd"

},

{

"key": "CL-DATE_OPEN",

"value": "2024-02-15 15:36:39"

},

{

"key": "CL-EMB_NAME_LAST",

"value": "JAMES ROBERT"

},

{

"key": "CL-INCOME",

"value": "0"

},

{

"key": "CL-IS_STAFF",

"value": "N"

},

{

"key": "CL-MOTHER_NAME",

"value": "Tima"

},

{

"key": "CL-NAME_FIRST",

"value": "James"

},

{

"key": "CL-NAME_LAST",

"value": "Robert"

},

{

"key": "CL-NAME_THIRD",

"value": "Ivich"

},

{

"key": "CL-NAME_TITLE",

"value": "MR"

},

{

"key": "CL-SAV_ACC_AM",

"value": "0"

},

{

"key": "CL-SCORE_LIMIT",

"value": "0"

},

{

"key": "CL-SCORE_LIMIT_APPR",

"value": "0"

},

{

"key": "CL-SCORE_VAL",

"value": "0"

},

{

"key": "CL-SEC_CH_AM",

"value": "0"

},

{

"key": "CL-SHORT_NAME",

"value": "Robert James"

}

]

}

}

}

}| Code | Description |

|---|---|

| 200 | Sample Description |

| 400 | Bad Request |

| 401 | Unauthorized |

| 403 | Forbidden |

| 500 | Internal Server Error |

| 502 | Bad gateway |

| 503 | Scheduled Maintenance |

| 504 | Gateway Timeout |

| 596 | Service Not Found |

| Code | Description | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Credit Solutions

Credit Solutions