Remittance Solutions

Overview

The Network Remittance solution offers plug-and-play integration that connects you to a high-volume remittance channel seamlessly. This gives you flexibility to choose the gateway or partner that suits your requirements based on quote rates and other preferences, allowing you to get the best possible foreign exchange rates to grow your revenue.

Convenience and Accessibility

Send money to virtually any country using multiple channels, including online platforms, mobile apps, physical locations, and bank transfers, ensuring flexibility and convenience for all users.

Cost-Effectiveness

Benefit from competitive fees and reduced transaction costs, offering affordable international fund transfers with efficient currency conversion and processing systems.

Speed and Efficiency

Experience expedited cross-border remittances, typically processed within minutes to a few hours, with the assurance of real-time transaction tracking for complete transparency and peace of mind.

Security

Ensure security and compliance with advanced fraud protection measures, encryption technologies, and adherence to regulatory standards, including anti-money laundering (AML) and know-your-customer (KYC) requirements.

Financial Inclusion

Services integrate with mobile wallets and payment systems, expanding financial access for users who rely on mobile technology.

Flexibility and Customization

Recipients can choose their preferred payment method, including direct bank deposits, cash pickups, or mobile money accounts, with the flexibility to send and receive money in multiple currencies.

Economic Benefits

Facilitating remittances not only supports families by providing quick and reliable funds but also boosts local economies, contributing to small businesses and overall economic development.

Customer Support

Cross-border remittance services provide round-the-clock customer support to address any issues or concerns, improving the overall user experience.

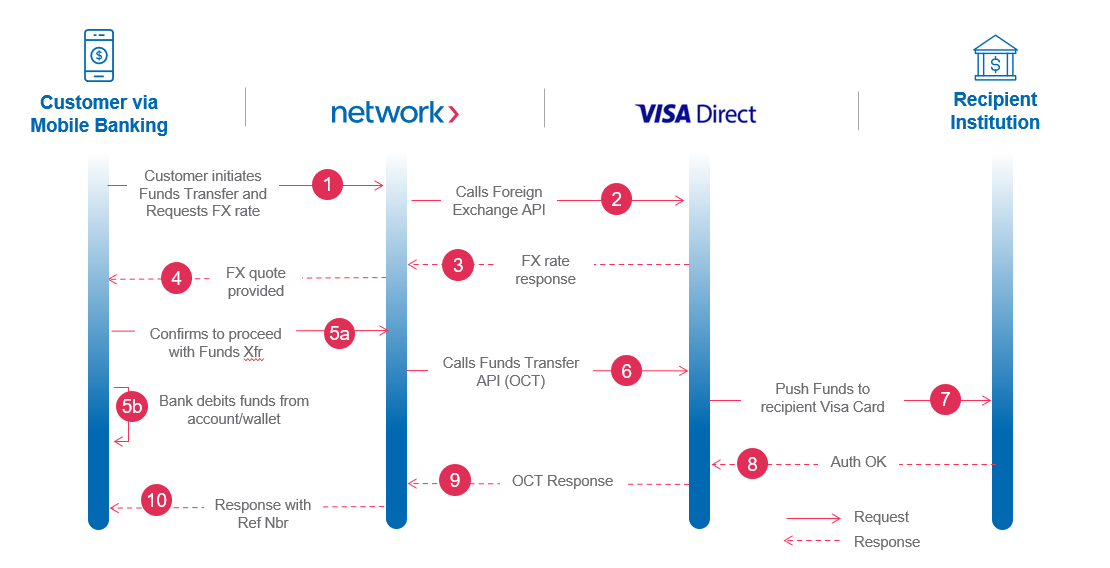

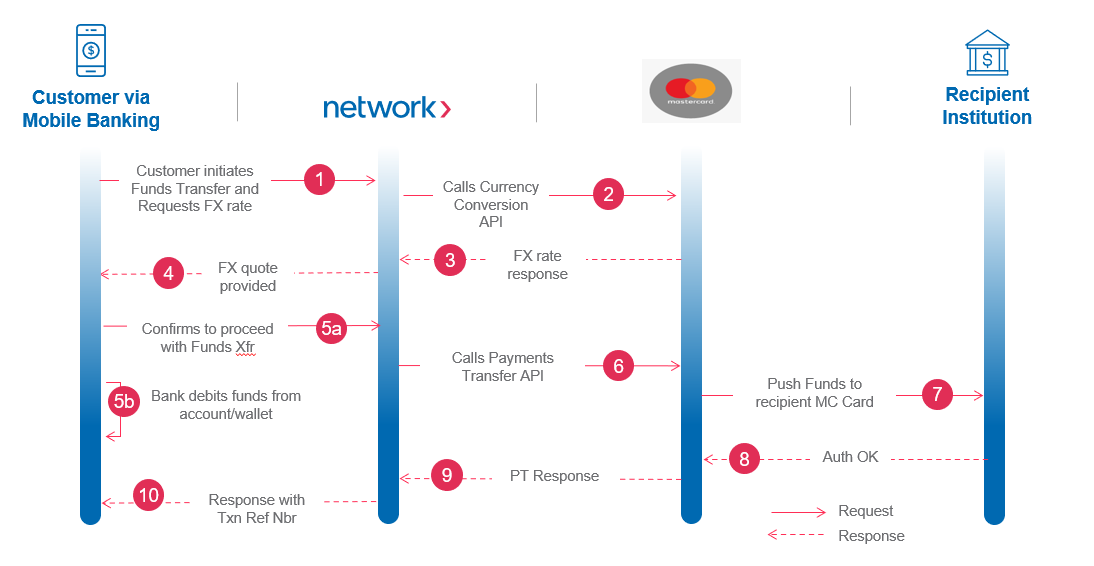

The remittance platform features a cutting-edge gateway engine. It provides cardholders with optimal foreign exchange rates through ecosystem partners. NI shall integrate with these partners and offer a unified set of APIs for cardholders. Integration efforts are minimal for funding institutions, ensuring a quick time to market.

It’s important to note that NI can assist in designing the UI/UX at the front end, provided the client agrees.

Remit to VISA - (Cards & Wallets)

Remit to Cards

Alias Resolve

Status:

Production

Version:

V2

Product:

Card Remittance Solution

Overview

Retrieve information about an Alias and the payment credential(s) associated with the Alias.

Status:

Production

Version:

V2

Product:

Card Remittance Solution

| Node | Child Node | Type | Length | Description |

|---|---|---|---|---|

| Authorization | Bearer xxxx | string | Authorization Header (Bearer Token) | |

| Content-Type | application/json | string | Content Type |

| Node Type | Type | Length | Description | |||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NISrvRequest | request_alias_resolve | header | msg_id | string | 12 | Message ID, this field should be unique id for each Api call. This will be generated from client side. If the same message ID is used the system will decline the API call with Error Description “Duplicate Message ID” | ||||||||||||||||||||||||||||

| msg_type | string | 12 | Message Type – This can have either “TRANSACTION” or “ENQUIRY” As for this API the value expected is “ENQUIRY” | |||||||||||||||||||||||||||||||

| msg_function | string | 50 | Static Value - REQ_ALIAS_RESOLVE | |||||||||||||||||||||||||||||||

| src_application | string | 10 | Source Application: This is a free Text and the client can populate the source system from where the API is Initiated Example: IVR, IB, MB No Validations of these are kept at Network Systems | |||||||||||||||||||||||||||||||

| target_application | string | 10 | The target_application can hold any value from FI side, this can be used by FI to check the target system of the API call | |||||||||||||||||||||||||||||||

| timestamp | string | 30 | Timestamp of the request - Format YYYY-MM-DDtHH:MM:SS.SSS+04:00 | |||||||||||||||||||||||||||||||

| tracking_id | string | 30 | Tracking_id of the request - Format YYYY-MM-DDtHH:MM:SS.SSS+04:00 | |||||||||||||||||||||||||||||||

| bank_id | string | 4 | Bank Id is Unique Id 4 digit code for each client and the same will be provided once the client setup is completed in our core system. For sandbox testing – Please use “REM” | |||||||||||||||||||||||||||||||

| body | alias_type | string | The type of Alias provided in aliasValue. ISO20022 element name: Proxy -> Type | |||||||||||||||||||||||||||||||

| alias_value | string | 128 | The value of the Alias, e.g., phone number or email address.

ISO20022 element name: Proxy -> Identification

If phone number is used for alias, this should be provided in accordance with ITU-T E.164 (2010) number structure. Please note that in the E.164 format, the "+" sign is not included. Below are some examples of phone numbers with different country codes:

| |||||||||||||||||||||||||||||||

| requestor_name | string | 50 | An identifier that represents the end user who is requesting an Alias Resolution. This field must not contain any PII information. | |||||||||||||||||||||||||||||||

{

"NISrvRequest": {

"request_alias_resolve": {

"header": {

"msg_id": "236001",

"msg_type": "ENQUIRY",

"msg_function": "REQ_ALIAS_RESOLVE",

"src_application": "BNK",

"target_application": "VISA",

"timestamp": "2024-03-06T11:45:02.366+04:00",

"tracking_id": "528",

"bank_id": "REM"

},

"body": {

"alias_type": "PHONE",

"alias_value": "1231231234",

"requestor_name": "username1234"

}

}

}

}| Node | Child Node | Type | Length | Description | |

|---|---|---|---|---|---|

| Content-Type | application/json | string | Content Type | ||

| Node Type | Type | Length | Description | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| NISrvResponse | response_alias_resolve | header | msg_id | string | 12 | Message ID, this field should be unique id for each Api call. This will be generated from client side. If the same message ID is used the system will decline the API call with Error Description “Duplicate Message ID” | ||||

| msg_type | string | 12 | Message Type – This can have either “TRANSACTION” or “ENQUIRY” As for this API the value expected is “ENQUIRY” | |||||||

| msg_function | string | 50 | Static Value - RES_ALIAS_RESOLVE | |||||||

| src_application | string | 10 | Source Application: This is a free Text and the client can populate the source system from where the API is Initiated Example: IVR, IB, MB No Validations of these are kept at Network Systems | |||||||

| target_application | string | 10 | The target_application can hold any value from FI side, this can be used by FI to check the target system of the API call | |||||||

| timestamp | string | 30 | Timestamp of the response Date & time Format DD/MM/YYYY HH:MM:SS | |||||||

| tracking_id | string | 30 | Tracking ID of the response Date & time Format DD/MM/YYYY HH:MM:SS | |||||||

| bank_id | string | 4 | Bank Id is Unique Id 4 digit code for each client and the same will be provided once the client setup is completed in our core system. For sandbox testing – Please use “REM” | |||||||

| exception_details | application_name | string | 20 | Application Name | ||||||

| date_time | string | 30 | Timestamp of the response Format “YYYY-MM-DD HH:MM:SS” | |||||||

| status | string | 1 | Status of the request (S/F) | |||||||

| error_code | string | 4 | EAI Internal Error Code (Check error codes section for the complete list of error codes and error code descriptions) | |||||||

| error_description | string | 100 | Error Description (Check error codes section for the complete list of error codes and error code descriptions) | |||||||

| transaction_ref_id | string | 20 | The tracking_id sent in the request will be sent back in response in this field. | |||||||

| body | card_number | string | 19 | Primary account number of the card | ||||||

| expiration_date | string | Expiration date for the card. YYYY-MM | ||||||||

| account_number_type | string | 19 | Card account number type | |||||||

| card_type | string | 70 | Card Type description. | |||||||

| issuer_name | string | 150 | Name of the issuer of the card | |||||||

| preferred_type | string | Type of preference. | ||||||||

| preferred_date | string | Date and time when set as preferred. | ||||||||

| recipient_first_name | string | 35 | Recipient First Name. | |||||||

| recipient_last_name | string | 6 | Recipient Last Name | |||||||

{

"NISrvResponse": {

"response_alias_resolve": {

"header": {

"msg_id": "236001",

"msg_type": "ENQUIRY",

"msg_function": "RES_ALIAS_RESOLVE",

"src_application": "BNK",

"target_application": "VISA",

"timestamp": "2024-03-06T11:50:02.366+04:00",

"tracking_id": "528",

"bank_id": "REM"

},

"exception_details": {

"application_name": "TCC-ADP",

"date_time": "2023-02-01T16:39:47.314+04:00",

"status": "S",

"error_code": "000",

"error_description": "Success",

"transaction_ref_id": "236001"

},

"body": {

"card_number": "",

"expiration_date": "",

"account_number_type": "4111111145551142",

"card_type": "Visa Platinum",

"issuer_name": "",

"preferred_type": "",

"preferred_date": "",

"recipient_first_name": "",

"recipient_last_name": ""

}

}

}

}| Code | Description |

|---|---|

| 200 | Sample Description |

| 400 | Bad Request |

| 401 | Unauthorized |

| 403 | Forbidden |

| 500 | Internal Server Error |

| 502 | Bad gateway |

| 503 | Scheduled Maintenance |

| 504 | Gateway Timeout |

| 596 | Service Not Found |

Card Remittance Solution

Card Remittance Solution