Remittance Solutions

Overview

The Network Remittance solution offers plug-and-play integration that connects you to a high-volume remittance channel seamlessly. This gives you flexibility to choose the gateway or partner that suits your requirements based on quote rates and other preferences, allowing you to get the best possible foreign exchange rates to grow your revenue.

Convenience and Accessibility

Send money to virtually any country using multiple channels, including online platforms, mobile apps, physical locations, and bank transfers, ensuring flexibility and convenience for all users.

Cost-Effectiveness

Benefit from competitive fees and reduced transaction costs, offering affordable international fund transfers with efficient currency conversion and processing systems.

Speed and Efficiency

Experience expedited cross-border remittances, typically processed within minutes to a few hours, with the assurance of real-time transaction tracking for complete transparency and peace of mind.

Security

Ensure security and compliance with advanced fraud protection measures, encryption technologies, and adherence to regulatory standards, including anti-money laundering (AML) and know-your-customer (KYC) requirements.

Financial Inclusion

Services integrate with mobile wallets and payment systems, expanding financial access for users who rely on mobile technology.

Flexibility and Customization

Recipients can choose their preferred payment method, including direct bank deposits, cash pickups, or mobile money accounts, with the flexibility to send and receive money in multiple currencies.

Economic Benefits

Facilitating remittances not only supports families by providing quick and reliable funds but also boosts local economies, contributing to small businesses and overall economic development.

Customer Support

Cross-border remittance services provide round-the-clock customer support to address any issues or concerns, improving the overall user experience.

The remittance platform features a cutting-edge gateway engine. It provides cardholders with optimal foreign exchange rates through ecosystem partners. NI shall integrate with these partners and offer a unified set of APIs for cardholders. Integration efforts are minimal for funding institutions, ensuring a quick time to market.

It’s important to note that NI can assist in designing the UI/UX at the front end, provided the client agrees.

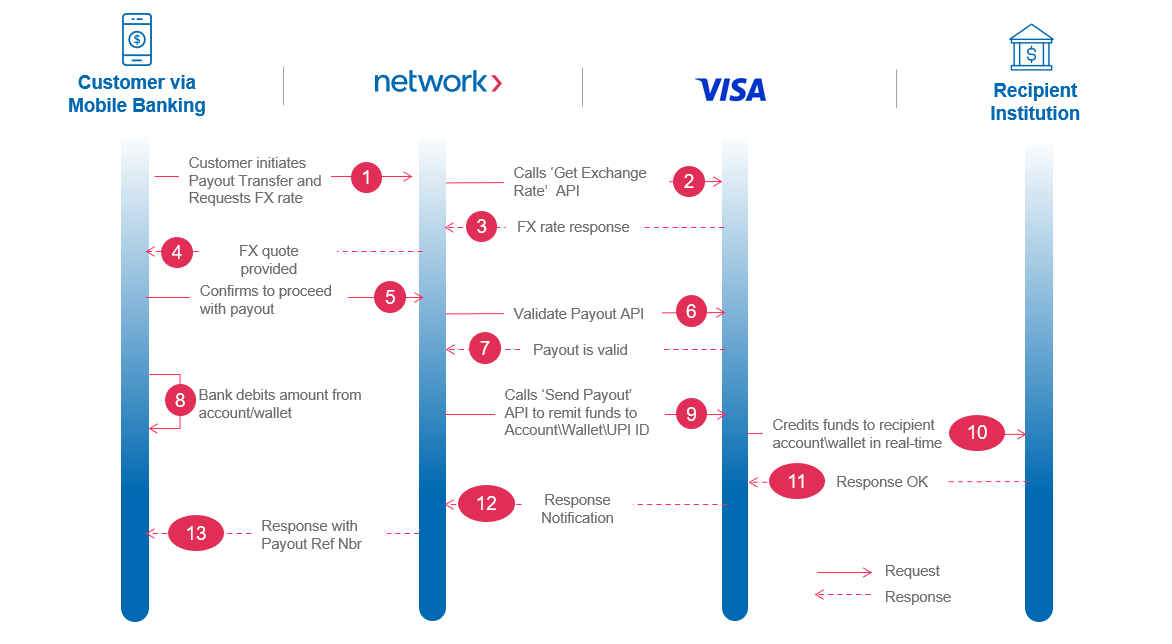

Remit to VISA - (Accounts & Wallets)

Remit to Accounts & Wallets

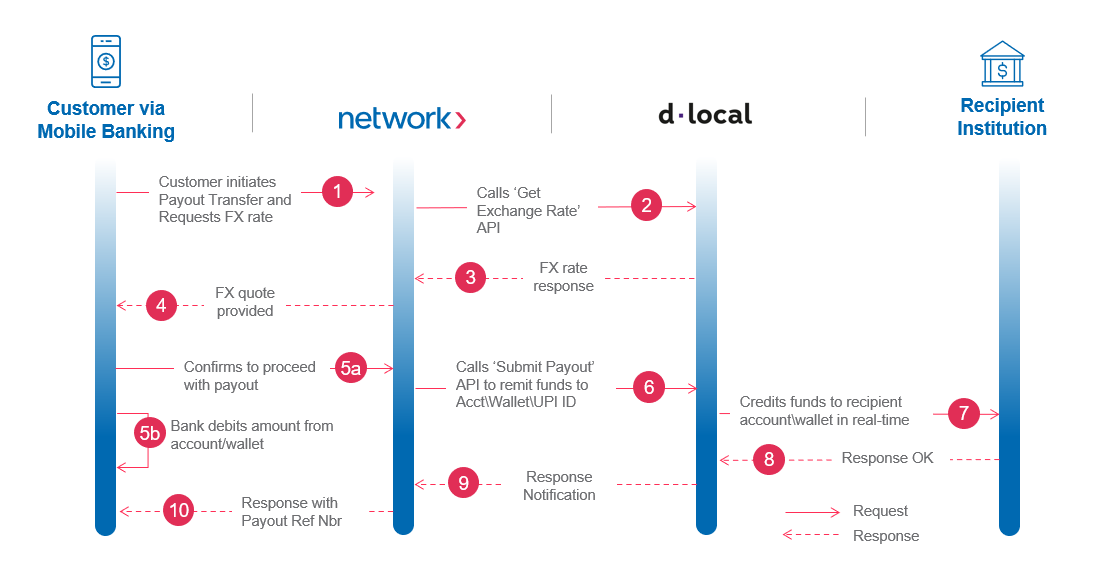

Account Remittance Solution

Account Remittance Solution