Create Client:

The Client Create API can be used by financial institutions to create new client records within our system. A client, in this context, can refer to a person or an organization. The API allows institutions to input and store personal information, addresses, and identity documents associated with the client. The client record is the highest level in the data hierarchy and serves as the foundation for other related information, such as accounts and transactions. The API allows institutions to input and store personal information, addresses, and identity documents associated with the client. The client record is the highest level in the data hierarchy and serves as the foundation for other related information, such as accounts and transactions. This API is typically used as a part of the onboarding process for new clients and can be integrated into existing systems and workflow.

Create Account:

An account creation API in a payment processing company allows users to create an account on the payment platform. This API is typically used by individuals or businesses who want to use the payment platform to send or receive payments.

Create Card:

A card creation API in a payment processing company allows users to add a credit or debit card to their account on the payment platform. This API is typically used by individuals or businesses who want to use the payment platform to make purchases or to receive payments.

Card Activation:

This API enables the activation of cards, allowing them to be used for transactions. New or replaced/renewed cards are initially locked by the system, preventing any transactions from being made with them. Through this API, cardholders can activate their cards, making them fully functional for both online and physical Point of Sale transactions. The API handles all necessary internal processes to activate the card.

Card Set Pin:

This API is used to set a PIN on a card. This is typically done for newly created cards or replaced ones, and is necessary for making Point of Sales (POS) purchases. The API can also be used in the event that the cardholder forgets their PIN, but it is important to note that strong verification of the cardholder's identity should be performed before enabling this feature (e.g. through the use of biometrics, security questions, or one-time passwords). The PIN provided through this API will be the one required for all POS purchases made with the card. To ensure the secure exchange of sensitive information, the API uses cryptography to protect the PIN.

Card Transaction:

This API is designed to record financial transactions on a card or account level. It accepts an account or card identifier as an input, along with the transaction type, amount, and currency. Once the API receives this information, it will post the transaction, which could be a debit or credit to the account balance. This feature enables businesses to charge fees, process payments, or top up prepaid accounts. The API can also be used to monitor and track transaction activity for accounting and compliance purposes.

Get Card Transactions:

This API allows developers to retrieve transaction history for a specific card. It requires one of the supported card identifier as an input and returns all transaction details within a specified date range. The API connects to the card issuer's management system and retrieves the transaction history for the provided card number. The returned information includes details such as transaction amount, merchant name, and transaction date. API has capability to list posted transactions, authorized transactions or statement transactions.

Card Balance Enquiry:

This API, designed to retrieve balances for a specified card, retrieves information such as the available amount, blocked or memo amount, due amount, and overdue amount. It should be noted that this API can only be utilized when the balances are stored in Network International's systems. It is not applicable for debit cards or prepaid cards with external store of value or wallets.

Cards List:

This API enables financial institutions to retrieve a comprehensive list of all cards associated with a specific cardholder, regardless of the card product type (Prepaid, Credit, or Debit). This API is an essential component of Mobile Banking or Home Banking applications, allowing institutions to input a client ID or account ID and retrieve all associated cards. The API response includes key information such as the masked PAN, expiration date, card product details, and status of each card.

Overview

Overview API Security

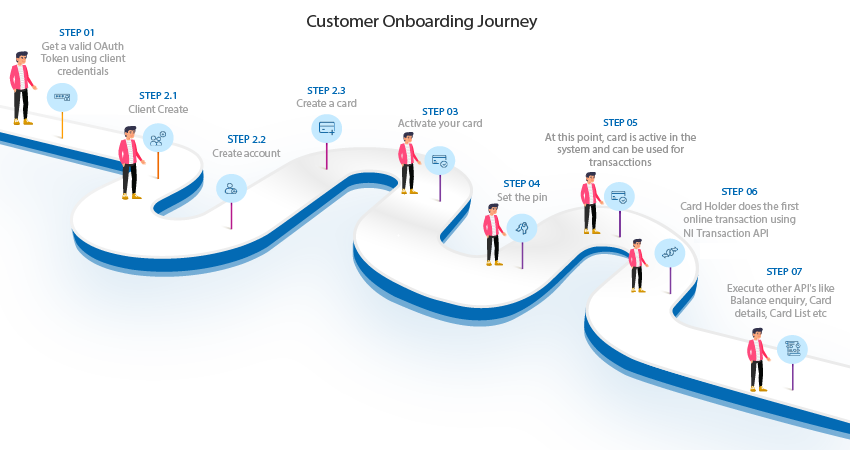

API Security Onboarding Journey

Onboarding Journey Appendix

Appendix